West Fraser Timber is a diversified wood products company with a simple and effective business model. While their exposure to the construction industry allows for potential growth opportunities, it also leaves them vulnerable to economic cycles. Recent quarters have been challenging for the company, and short-term macro signals do not look ideal. However, West Fraser Timber has a proven track record of navigating different economic cycles and has shown resilience in weathering downturns. With a strong balance sheet, low debt, and positive cash flow, the company appears to be in a solid financial position. Despite an attractive valuation based on book value and EV/Sales ratio, the author advises caution due to potential market downturns and a housing slowdown. Currently, the author rates West Fraser Timber as a hold, but would consider adding it to their portfolio when market conditions improve.

Overview of West Fraser Timber

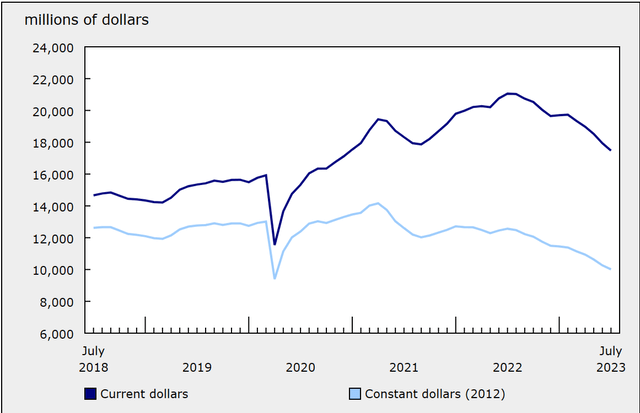

West Fraser Timber is a leading diversified wood products company with a simple and effective business model. Their business operations encompass timber harvesting, sawmills, wood products, pulp & paper, and value-added products. The company has established a solid reputation in the industry for its commitment to quality and sustainable practices.

Exposure to Construction Industry

As a wood products company, West Fraser Timber’s exposure to the construction industry is both a boon and a bane. On one hand, the demand for their products, such as lumber, plywood, and engineered wood, is closely tied to the construction sector. During periods of economic expansion and robust construction activity, the company experiences increased demand and higher revenue. However, during economic downturns or housing market slowdowns, the demand for their products tends to decline, impacting their profitability.

This image is property of static.seekingalpha.com.

Recent Performance

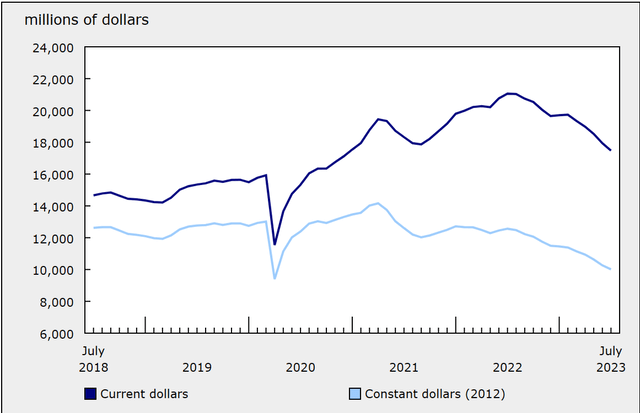

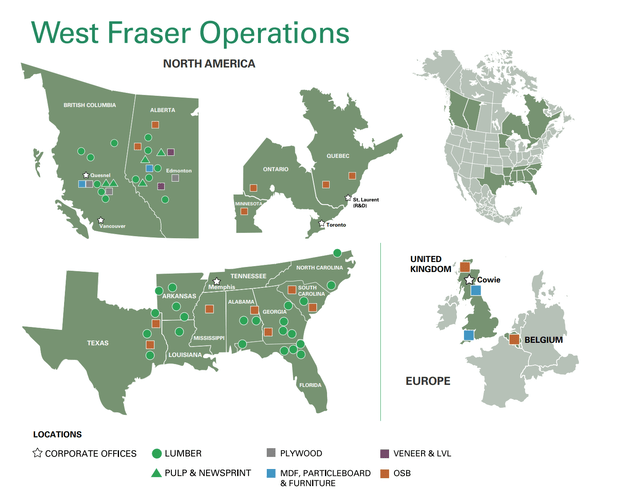

In recent quarters, West Fraser Timber has faced some challenges in its performance. Short-term macro signals, such as fluctuations in housing starts and building permits, have not been ideal for the company. These signals can serve as indicators of future demand for their products and have a significant impact on their financial performance. Additionally, recent quarters have brought additional pain for West Fraser Timber, as they have faced increased competition, rising input costs, and supply chain disruptions.

Author’s Interest

Despite the recent challenges, West Fraser Timber is on the author’s radar. The author recognizes the company’s strong reputation in the industry and believes that it has the potential for long-term growth and value creation. However, the author acknowledges the importance of timing in portfolio decisions. They would add West Fraser Timber to their portfolio when the macroeconomic conditions and market sentiments are more favorable.

This image is property of static.seekingalpha.com.

Business Segments

West Fraser Timber operates in multiple business segments, each contributing to the company’s overall success:

- Timber Harvesting: The company owns and operates timberlands, where they engage in sustainable forestry practices to ensure a steady supply of raw materials for their wood products.

- Sawmills: West Fraser Timber operates sawmills that convert logs into lumber and other wood products. With their state-of-the-art facilities and efficient production processes, they are able to meet the demand for high-quality lumber.

- Wood Products: The company manufactures and markets a range of wood products, including plywood, laminated veneer lumber, and engineered wood. These products are used in a variety of applications, such as construction, furniture, and packaging.

- Pulp & Paper: West Fraser Timber also has a presence in the pulp and paper industry. They produce and sell pulp and paper products that are used in printing, packaging, and tissue manufacturing.

- Value-added Products: In addition to their primary product offerings, West Fraser Timber also focuses on developing value-added products. This includes innovative wood products with enhanced properties or specialized applications, catering to specific market niches and customer needs.

Ability to Navigate Economic Cycles

One of the strengths of West Fraser Timber is its proven track record in navigating economic cycles. The company has weathered various downturns in the past, demonstrating its resilience and adaptability. They have made strategic investments in technology and operational efficiency, allowing them to optimize their production processes and reduce costs during challenging times. This experience and ability to navigate economic cycles gives West Fraser Timber a competitive edge and positions them well for future growth.

This image is property of static.seekingalpha.com.

Strong Balance Sheet

West Fraser Timber boasts a strong balance sheet, characterized by low levels of debt and positive cash flow. This financial stability provides the company with flexibility and the ability to invest in growth opportunities. With a conservative approach to debt management, West Fraser Timber is well positioned to weather economic uncertainties and pursue strategic initiatives that enhance shareholder value.

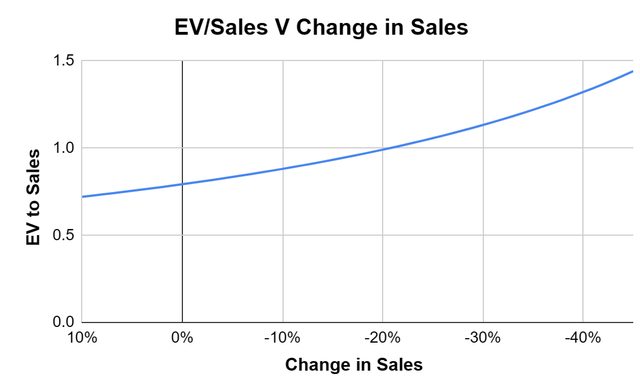

Attractive Valuation

From a valuation perspective, West Fraser Timber appears attractive. The company’s stock valuation based on book value suggests that it is trading at a reasonable price relative to its assets. Additionally, the company’s EV/Sales ratio indicates that it is priced favorably in relation to its revenue generation. These valuation metrics make West Fraser Timber an appealing investment option for those seeking value opportunities.

This image is property of static.seekingalpha.com.

Market Timing Considerations

While the valuation may be attractive, investors should consider market timing before making investment decisions. There are potential market downturns on the horizon, which could impact the construction industry and the demand for West Fraser Timber’s products. Additionally, there are signs of a housing slowdown, which could further dampen demand for their wood products. Considering these factors, it may be prudent to wait for better market conditions before fully committing to an investment in West Fraser Timber.

Author’s Rating and Recommendations

Based on the aforementioned analysis, the author rates West Fraser Timber as a hold. While the company’s strong reputation, diversified business segments, and ability to navigate economic cycles are commendable, the current market conditions and potential downturns warrant caution. The author believes that West Fraser Timber has the potential for long-term growth and value creation, but the timing is critical. Investors should wait for better market conditions and monitor the housing sector before considering West Fraser Timber as a buy.

This image is property of static.seekingalpha.com.