“Bridgford Foods Corporation, a leading producer and distributor of frozen, refrigerated, and snack food items, is on a path of compounding growth through the expansion of its distribution network. Despite facing macroeconomic headwinds, the company’s solid balance sheet and strategic efforts to improve cash flows position it as a promising investment opportunity. By forming alliances with major retail chains, maximizing product visibility, and exploring e-commerce options, Bridgford aims to enhance accessibility and reach a wider audience. These distribution strategies not only drive sales and brand recognition but also contribute to improved cash flows and greater free cash flow for the company’s core business expansion. With an undervaluation in the market and a potential upside of 22%, Bridgford presents itself as an attractive investment choice.”

Business Overview

Bridgford Foods Corporation is a company engaged in the production, promotion, and distribution of frozen, refrigerated, and snack food items within the United States. The company operates in two main divisions: snack food products and frozen food products. Their product line includes biscuits, bread and roll dough goods, dry sausage, beef jerky, and a wide variety of frozen food items and snack food products. These products are distributed to retail clients, the food service industry, supermarkets, mass merchandisers, convenience stores, and other similar businesses. Bridgford Foods aims to expand its distribution network to ensure easy access to its products and improve sales and brand recognition.

Financials

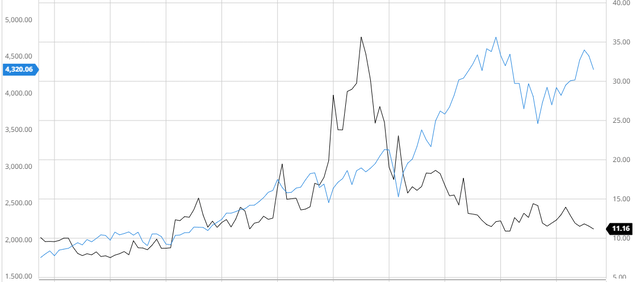

Bridgford Foods Corporation is currently valued at approximately $101.3 million in the market, with a Return on Invested Capital of 3%. The stock is priced at $11.16 per share, slightly below its 200-day moving average of $12.26. The company has a lower P/E GAAP ratio compared to its peers, indicating an undervaluation. Although Bridgford does not pay a dividend, the company has reduced its debt significantly and is committed to investing in its core business to generate greater shareholder value in the future.

This image is property of static.seekingalpha.com.

Earnings

Bridgford recently reported disappointing earnings in Q3 2023, with net income falling from $41.3 million to $684,000 and sales dropping from $59.52 million to $54.2 million. These earnings reflect the challenges the company is facing during macro headwinds, which have impacted its cash flows. However, Bridgford can leverage its solid balance sheet and distribution expansion to stabilize cash flows in the long term.

Balance Sheet

Bridgford maintains a robust financial position with a substantial reduction in debt and an enhanced interest coverage ratio of 7.83. This low-debt balance sheet provides the company with flexibility for potential leveraging, especially during challenging macroeconomic conditions that may strain cash flows. With a Current Ratio of 3.46 and an Altman-Z-Score of 4.14, Bridgford’s ongoing operations are stable and promising for the near to medium term.

This image is property of static.seekingalpha.com.

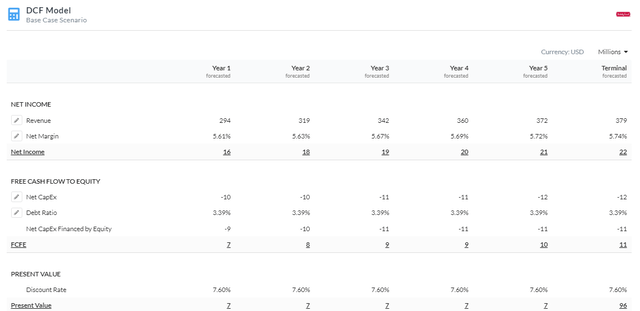

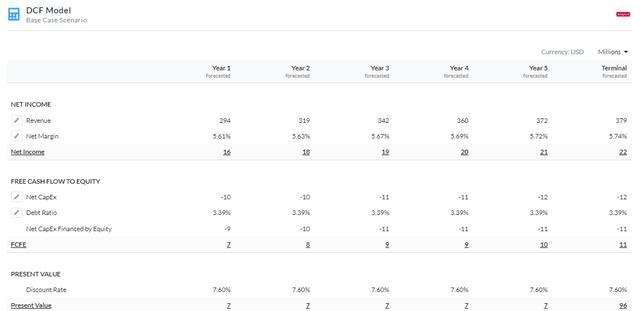

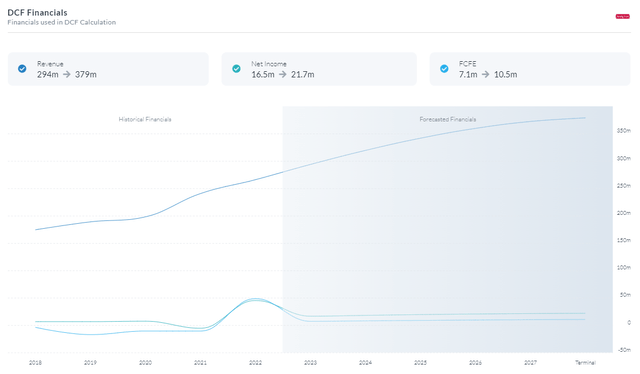

Valuation

To calculate an accurate fair value for Bridgford, the Cost of Equity was determined using the risk-free rate from the 10-year treasury yield. Based on this rate, a Cost of Equity of 7.6% was derived. A 5-year Equity Model DCF using FCFE was created, assuming the previously calculated Cost of Equity. The discounted cash flow analysis resulted in a fair value of $14.36, indicating a potential upside of 22%. This valuation suggests that Bridgford is undervalued and presents a good investment opportunity.

Distribution Network Expansion Resulting in Compounding Growth

As part of its corporate strategy, Bridgford Foods is dedicated to expanding its distribution network. By maximizing the delivery of its products to retail locations and end users, the company aims to ensure easy access to its offerings. Strategic alliances with significant retail chains and distributors have helped enhance Bridgford’s distribution network, increasing product visibility, shelf space, and brand recognition. The company has also explored the expansion of its distribution options through e-commerce, tapping into the growing trend of online shopping. These efforts to make its products more easily accessible to a wider audience will improve sales, expand margins, and result in improved cash flows and greater free cash flow. This will enable Bridgford to further expand its core business and outpace competitors.

This image is property of static.seekingalpha.com.

Risks

Like any other business, Bridgford Foods faces certain risks that could impact its operations and financial performance. Some of the key risks include:

Operational Risks:

- Natural disasters, supply chain disruptions, labor issues, and other operational challenges can affect production and distribution, leading to reduced sales and profits.

Market Volatility and Fluctuating Commodity Prices:

- Price fluctuations for ingredients like wheat, beef, and other raw commodities can impact manufacturing costs and overall profitability, potentially affecting the company’s financial performance.

Regulatory and Compliance Risks:

- Regulations governing food safety and quality must be followed to avoid product recalls, legal action, reputational harm, and financial losses. Non-compliance with these regulations can have significant negative impacts on the company’s operations and financials.

Conclusion

In conclusion, Bridgford Foods Corporation is undervalued and has a solid balance sheet, making it a good investment despite macro headwinds. The company’s focus on expanding its distribution network will lead to compounding growth and improved cash flows. While recent earnings have been weak, Bridgford’s ability to leverage from its solid balance sheet and distribution expansion will help stabilize cash flows in the long term. With the potential for a 22% upside based on valuation, Bridgford is a buy. However, investors should be aware of the risks associated with the business, such as operational challenges, market volatility, and regulatory compliance. Overall, Bridgford Foods has the potential to deliver long-term growth and generate value for its shareholders.

This image is property of static.seekingalpha.com.