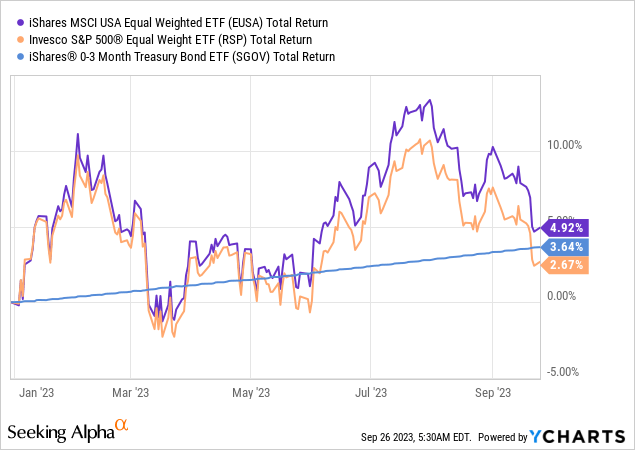

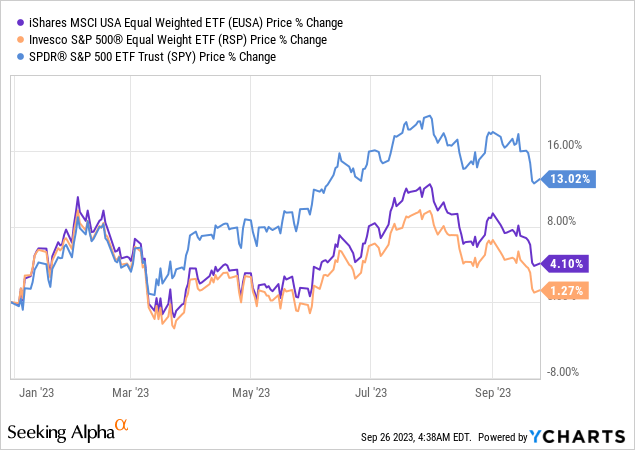

The iShares MSCI USA Equal Weighted ETF (EUSA) has struggled to deliver a strong performance this year, with a total return of only 4.9%. This equity exchange-traded fund tracks the MSCI USA Equal Weighted Index, which provides an equal-weight take on the large and mid-cap segments of the US market. Despite having a standard deviation in line with the S&P 500, EUSA has failed to generate substantial positive returns. With stretched valuation metrics and the impact of rising rates on mid-cap equities, it may not be an attractive choice for investors.

This image is property of static.seekingalpha.com.

Thesis

The iShares MSCI USA Equal Weighted ETF (EUSA) is an equity exchange-traded fund that tracks the MSCI USA Equal Weighted Index. In 2023, EUSA has had a performance in line with the Invesco S&P 500 Equal Weight ETF (RSP). This article will provide an overview of EUSA, analyze its performance and risk factors, compare it to RSP, and assess its potential as an investment choice.

Overview of the iShares MSCI USA Equal Weighted ETF (EUSA)

EUSA is an equity exchange-traded fund that aims to replicate the performance of the MSCI USA Equal Weighted Index. The index is an equal-weight take on large and mid-cap segments of the US market. With 627 holdings, EUSA provides a diversified exposure to the US stock market. The fund rebalances quarterly, ensuring that each component has the same weight.

This image is property of static.seekingalpha.com.

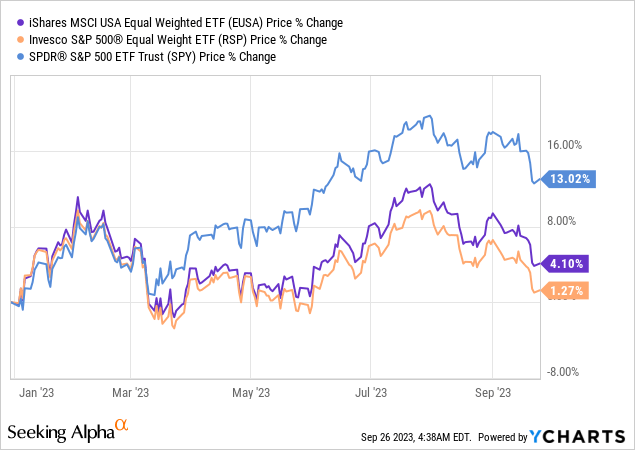

Performance of EUSA in 2023

EUSA has failed to post a substantial performance this year, with a total return of only 4.9%. This can be attributed to the absence of an overweight position in the ‘Magnificent 7’, which have propelled the S&P 500 higher. The rest of the stock market, particularly mid-caps and smaller caps, have had muted returns due to the rising cost of funds and higher interest rates. The fund’s performance reflects the overall equity market conditions.

Comparison to Invesco S&P 500 Equal Weight ETF (RSP)

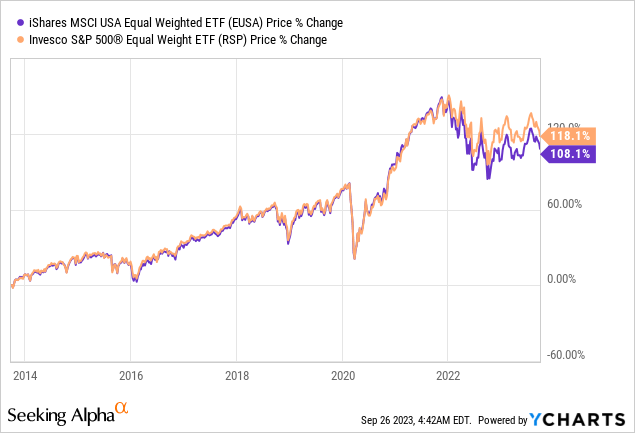

EUSA closely matches the performance of RSP, which is a better-known equal weight ETF. Both funds historically have a strong price correlation, with only a slight divergence recently due to EUSA’s tilt towards mid-caps. RSP also follows an equal-weighted index methodology and rebalances quarterly. Investors looking for an equal-weighted exposure to the US equity market can consider both EUSA and RSP, keeping in mind their slight differences in composition.

This image is property of static.seekingalpha.com.

Risk Factors for EUSA

The main risk driver for EUSA is mid-cap equities in the US. The valuation metrics for the fund are stretched, with a P/E ratio of 17.2x. As long-term yields are aggressively moving higher, higher rates translate into a higher discount rate for equities, resulting in lower prices. In the current economic cycle, with high rates and tighter lending conditions, EUSA may face challenges in producing significant results. Investors should be mindful of this risk when considering EUSA as an investment choice.

MSCI USA Equal Weighted Index

The MSCI USA Equal Weighted Index represents an alternative weighting scheme to its market cap weighted parent index, the MSCI USA Index. It includes the same constituents as its parent, which are large and mid-cap securities from US markets. However, at each quarterly rebalance, all index constituents are weighted equally, effectively removing the influence of each constituent’s current price. The sector composition of the index includes Information Technology, Industrials, and Financials as its top components.

This image is property of static.seekingalpha.com.

Analytics

EUSA has an Assets Under Management (AUM) of $0.52 billion. The fund’s Sharpe Ratio, a measure of risk-adjusted return, is 0.49 for the past three years. The Standard Deviation, which indicates volatility, is 18.9 for the past three years, similar to the S&P 500. The Yield of the fund is 1.6%, and the Leverage Ratio is 0%, indicating no leverage is used. EUSA follows an equal weight composition, ensuring each holding has an equal weight in the portfolio.

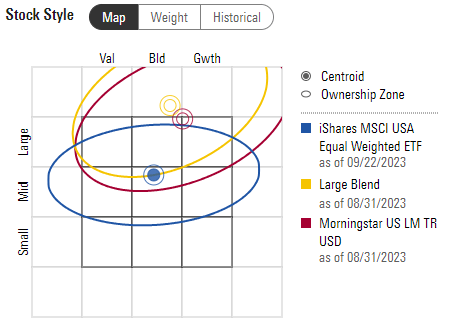

MSCI USA Index Holdings

EUSA falls in the Mid Cap-Blended Morningstar portfolio category. The fund holds over 600 names, providing a diversified exposure to mid-cap equities in the US. The top holdings within EUSA are all under 0.3% of the fund’s holdings, reflecting an equal weight composition. It is important to note that individual name weightings may fluctuate between rebalancing dates due to price performance, but are smoothed out on the rebalance date.

This image is property of static.seekingalpha.com.

Performance

EUSA has closely mirrored the performance of its peer, Invesco S&P 500 Equal Weight ETF, in 2023. Long-term, EUSA has shown a close match to the performance of RSP. The historical performance of both funds indicates their ability to track their respective equal-weighted indexes. However, in 2023, the overall performance of EUSA has been impacted by the absence of an overweight position in the ‘Magnificent 7’ and the challenges faced by mid-cap equities in the current economic cycle.

Conclusion

EUSA provides investors with an equal-weighted exposure to the US equity market, particularly large and mid-cap segments. However, in the current economic cycle, with rising interest rates and tighter lending conditions, the fund has failed to produce substantial returns. With a high standard deviation, high P/E ratio, and low total return in 2023, EUSA may not be a compelling investment choice at this stage. Investors looking for an equal-weighted exposure to the US equity market can consider RSP or wait for a more favorable market environment. The outlook for the US equity market remains uncertain, and investors should carefully evaluate the risk factors before making investment decisions.