In the realm of financial analysis, the evaluation of a company’s financial performance is a crucial undertaking. By examining various aspects such as assets, equity, expenses, liabilities, revenue, and profitability, analysts are able to gain insight into a company’s overall financial standing. To conduct an accurate and comprehensive analysis, there are several essential documents that must be considered. These documents, including the balance sheet, income statement, cash flow statement, profit and loss statement, and general ledger, provide a holistic view of a company’s financial performance. Additionally, it is important for analysts to monitor and assess key financial metrics such as gross profit margin, net profit margin, working capital, current ratio, quick ratio, leverage, return on equity, return on assets, inventory turnover, and operating cash flow. Furthermore, there are four key areas that serve as key measures of a company’s financial health: liquidity, solvency, profitability, and operating efficiency. By carefully examining these facets of financial performance, analysts are able to gauge the overall stability and success of a company.

Essential Documents for Financial Performance Analysis

Financial performance analysis is a crucial process in evaluating a company’s financial standing and performance. It involves assessing various categories such as assets, equity, expenses, liabilities, revenue, and profitability. To conduct a thorough analysis, several essential documents are required. These documents provide valuable insights into a company’s financial health and help analysts make informed decisions. The following are the essential documents for financial performance analysis:

Balance Sheet

One of the primary documents used in financial performance analysis is the balance sheet. It provides a snapshot of a company’s financial position at a specific point in time. The balance sheet consists of three main components: assets, liabilities, and equity. By examining the balance sheet, analysts can assess the company’s liquidity, solvency, and overall financial stability. It helps determine how effectively a company is managing its assets and liabilities, as well as its ability to meet its financial obligations.

Income Statement

Another crucial document in financial performance analysis is the income statement, also known as the profit and loss statement. It provides a summary of a company’s revenues, expenses, and net income or loss over a specific period. The income statement helps analysts evaluate a company’s profitability and financial performance. By analyzing the income statement, one can assess the company’s ability to generate revenue and control its expenses. It also highlights trends in revenue and costs and provides insights into the company’s overall financial success.

Cash Flow Statement

The cash flow statement is another important document that helps evaluate a company’s financial performance. It provides detailed information about a company’s cash inflows and outflows over a specific period. The cash flow statement is divided into three sections: operating activities, investing activities, and financing activities. By analyzing the cash flow statement, analysts can assess a company’s ability to generate cash, manage its working capital, and meet its financial obligations. It also helps identify any potential cash flow issues or liquidity concerns.

Profit and Loss Statement

The profit and loss statement, also known as the income statement, is a critical document in financial performance analysis. It summarizes a company’s revenues, expenses, and net income or loss over a specific period. By examining the profit and loss statement, analysts can evaluate the company’s profitability and financial performance. It helps identify trends in revenue and costs, assess the overall financial success of the company, and determine its ability to generate profit.

General Ledger

The general ledger is a fundamental document for financial performance analysis. It provides a complete record of all financial transactions of a company, organized by accounts. The general ledger includes information about assets, liabilities, equity, revenue, and expenses. By analyzing the general ledger, analysts can track and verify all financial transactions, identify any errors or discrepancies, and gain a comprehensive understanding of the company’s financial activities. It is a crucial tool for ensuring accuracy and integrity in financial reporting.

This image is property of www.financealliance.io.

Important Financial Performance Metrics

In addition to the essential documents, several key financial performance metrics play a vital role in evaluating a company’s financial health and performance. These metrics provide valuable insights into various aspects of a company’s operations and help assess its overall financial position. The following are important financial performance metrics to monitor and assess:

Gross Profit Margin

The gross profit margin is a metric that measures a company’s profitability. It represents the percentage of revenue that remains after deducting the cost of goods sold (COGS). A high gross profit margin indicates that a company is effectively managing its production and procurement costs and generating sufficient revenue to cover its expenses and still make a profit.

Net Profit Margin

Similar to the gross profit margin, the net profit margin measures a company’s profitability. However, it represents the percentage of revenue that remains after deducting all expenses, including COGS, operating expenses, interest, and taxes. The net profit margin provides a more comprehensive picture of a company’s profitability as it considers all costs incurred in generating revenue.

Working Capital

Working capital is a key metric that assesses a company’s liquidity and short-term financial health. It represents the difference between a company’s current assets and current liabilities. Positive working capital indicates that a company has sufficient current assets to cover its short-term liabilities and fund its day-to-day operations. It demonstrates the company’s ability to manage its short-term obligations and maintain liquidity.

Current Ratio

The current ratio is a liquidity ratio that measures a company’s ability to meet its short-term obligations. It is calculated by dividing current assets by current liabilities. A high current ratio indicates that a company has a strong liquidity position and can easily cover its short-term liabilities. It provides insights into a company’s short-term solvency and financial stability.

Quick Ratio

The quick ratio, also known as the acid-test ratio, is another liquidity ratio that assesses a company’s ability to meet its short-term obligations using its most liquid assets. It is calculated by subtracting inventories from current assets and dividing the result by current liabilities. The quick ratio excludes inventories from current assets as they are generally less liquid. A high quick ratio indicates that a company has a strong ability to meet its short-term obligations without relying on the sale of inventory.

Leverage

Leverage is a financial ratio that measures the extent to which a company relies on debt to finance its operations. It is calculated by dividing total debt by total equity. Leverage reflects a company’s risk profile and the proportion of debt in its capital structure. High leverage indicates that a company has a higher level of financial risk and is more susceptible to changes in interest rates or economic downturns. It is important to carefully manage leverage to maintain a healthy financial position.

Return on Equity

Return on equity (ROE) is a profitability ratio that measures the return generated on shareholders’ equity. It is calculated by dividing net income by shareholders’ equity. ROE represents the efficiency with which a company utilizes its equity to generate profits. A high ROE indicates that a company is generating a strong return on its shareholders’ investment.

Return on Assets

Return on assets (ROA) is a profitability ratio that measures the return generated on a company’s total assets. It is calculated by dividing net income by total assets. ROA demonstrates a company’s ability to generate profits from its assets. A high ROA indicates that a company is effectively utilizing its assets to generate income.

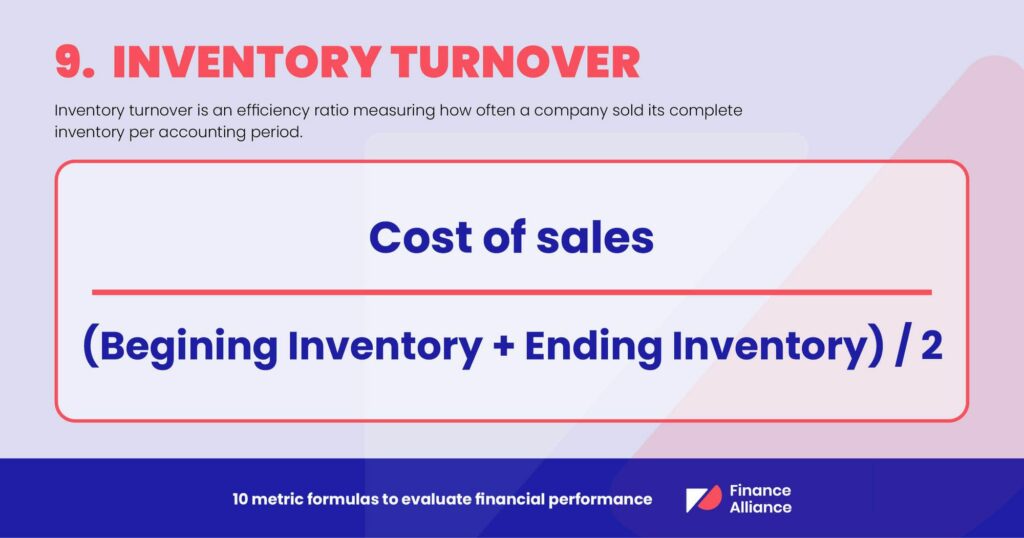

Inventory Turnover

Inventory turnover is an efficiency ratio that measures the number of times a company sells and replaces its inventory during a specific period. It is calculated by dividing the cost of goods sold by the average inventory. Inventory turnover provides insights into a company’s ability to manage its inventory levels and generate sales. A high inventory turnover indicates that a company is effectively managing its inventory and selling its products efficiently.

Operating Cash Flow

Operating cash flow is a key metric that assesses a company’s cash generation from its core operations. It represents the cash generated or consumed by a company’s operating activities, excluding any investment or financing activities. Positive operating cash flow indicates that a company is generating sufficient cash to fund its day-to-day operations. It demonstrates the company’s ability to generate cash from its core business activities.

This image is property of www.financealliance.io.

Areas of Financial Health

Financial health is a broad concept that encompasses several aspects of a company’s financial performance and stability. By evaluating specific areas of financial health, analysts can gain a comprehensive understanding of a company’s overall financial position. The following are the four areas of financial health that are key measures of a company’s performance:

Liquidity

Liquidity is a measure of a company’s ability to meet its short-term obligations using its current assets. It indicates the company’s ability to convert its assets into cash quickly and cover its immediate financial needs. A company with good liquidity has sufficient cash or liquid assets to meet its short-term liabilities and fund its day-to-day operations. It is important to maintain a healthy level of liquidity to ensure smooth operations and avoid potential financial difficulties.

Solvency

Solvency is a measure of a company’s long-term financial stability and ability to meet its long-term obligations. It assesses the company’s ability to generate enough cash flow to cover its long-term debts and commitments. A company with good solvency can manage its debt obligations and sustain its operations in the long run. It is important to maintain a healthy solvency ratio to instill confidence in investors and lenders.

Profitability

Profitability is a measure of a company’s ability to generate profits from its operations. It assesses the company’s ability to generate revenue, control costs, and generate a return on investment. Profitability ratios such as gross profit margin, net profit margin, return on equity, and return on assets provide insights into a company’s financial success and efficiency. It is important to maintain a healthy level of profitability to ensure sustained growth and financial stability.

Operating Efficiency

Operating efficiency is a measure of how effectively a company utilizes its resources and assets to generate revenue. It assesses the company’s ability to minimize costs, improve productivity, and streamline operations. Operating efficiency metrics, such as inventory turnover and operating cash flow, provide insights into a company’s operational effectiveness. It is important to continuously improve operating efficiency to maximize profitability and competitiveness in the market.

In conclusion, financial performance analysis is a critical process in evaluating a company’s financial standing and performance. Essential documents such as the balance sheet, income statement, cash flow statement, profit and loss statement, and general ledger provide valuable insights into a company’s financial health. Important financial performance metrics, including gross profit margin, net profit margin, working capital, current ratio, quick ratio, leverage, return on equity, return on assets, inventory turnover, and operating cash flow, help assess various aspects of a company’s financial performance. Lastly, evaluating areas of financial health, such as liquidity, solvency, profitability, and operating efficiency, provides a comprehensive understanding of a company’s overall financial position. By conducting a thorough financial performance analysis, companies can make informed decisions, identify areas of improvement, and ensure long-term financial success.

This image is property of www.financealliance.io.