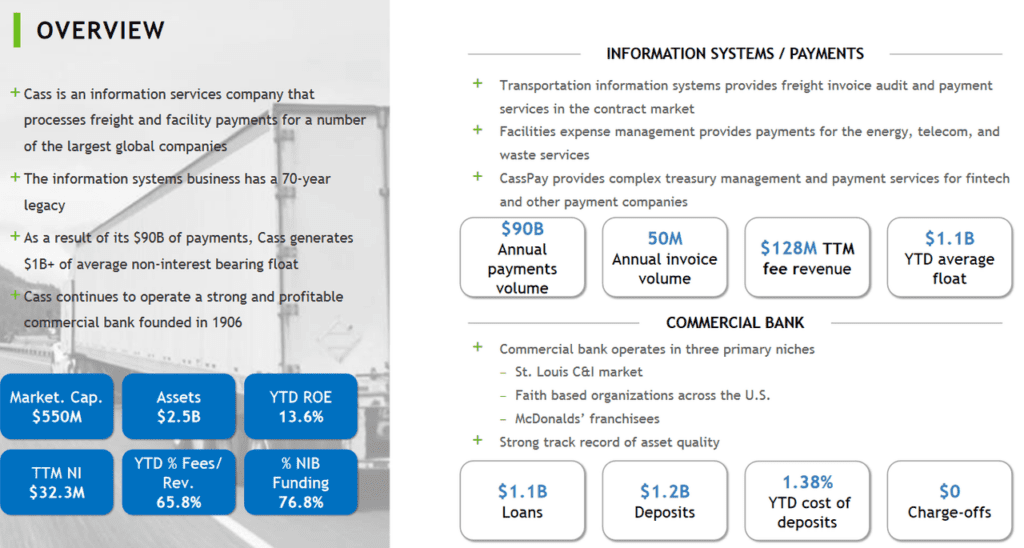

Cass Information Systems Inc. has encountered obstacles in its quest to increase its bottom line, primarily stemming from decreased business activity from its operating clients and rising operating expenses. As a prominent provider of payment and information management solutions across diverse industries, Cass Information Systems Inc. has witnessed a decline in profit margins but has a commendable track record of consistently increasing dividends. However, one potential concern in the current market landscape is whether the company’s valuation might be inflated. In this article, we will explore the challenges faced by Cass Information Systems Inc. in attaining sustainable growth and examine potential strategies to overcome these obstacles.

This image is property of static.seekingalpha.com.

Weaker activity from operating clients

Cass Information Systems Inc. has experienced a decrease in activity from its operating clients, which has posed challenges to its growth and bottom line. The company, known for its expertise in payment and information management solutions, provides its services to businesses across various industries. However, factors such as economic downturns, industry-specific challenges, and changing business needs have contributed to reduced activity from these clients.

The declining activity from operating clients has had a direct impact on Cass Information Systems Inc.’s revenue and overall financial performance. With fewer transactions and business activities to process, the company’s top line has been adversely affected, leading to a slower growth trajectory. This has prompted the company’s management to explore new avenues for revenue generation, such as diversifying its client base and exploring new markets and industries where the demand for its services remains strong.

Financial impacts of weaker activity

The decrease in activity from operating clients has not only affected Cass Information Systems Inc.’s top line but has also put pressure on its profitability. With fewer transactions being processed, the company’s operating expenses have remained relatively fixed, resulting in higher costs per transaction. This has reduced the overall profitability of the company and has led to lower net income.

In addition, Cass Information Systems Inc. has also faced challenges in managing and optimizing its resources due to the weaker activity from operating clients. With fewer transactions to handle, the company has had to find ways to efficiently utilize its infrastructure, technology, and workforce to ensure optimal productivity and cost-effectiveness. This has required the company to streamline its operations, automate certain processes, and restructure its workforce, leading to additional costs and challenges.

Higher operating expenses

In addition to the weaker activity from operating clients, Cass Information Systems Inc. has also encountered higher operating expenses, further impacting its bottom line. The company’s operating expenses encompass various costs incurred in the day-to-day operations of the business, including employee salaries, technology investments, marketing expenses, and administrative overheads.

The increase in operating expenses can be attributed to several factors. First, Cass Information Systems Inc. has invested heavily in technology to enhance its service offerings and improve operational efficiency. While these investments are critical for the long-term growth and sustainability of the company, they have contributed to higher operating expenses in the short term.

Second, the company has also faced rising employee costs, including salaries and benefits. As Cass Information Systems Inc. strives to attract and retain top talent in the industry, it has had to offer competitive remuneration packages, which has increased its overall personnel expenses. Additionally, the company has also incurred costs related to training and development programs aimed at enhancing the skills and capabilities of its workforce.

Lastly, Cass Information Systems Inc. has had to allocate resources towards marketing and business development efforts to counter the effects of weaker activity from operating clients. These initiatives involve promotional activities, client engagement programs, and market research, which have contributed to the overall increase in operating expenses.

Managing higher operating expenses

To mitigate the impact of higher operating expenses, Cass Information Systems Inc. has implemented various strategies. The company has focused on optimizing its operations, identifying areas of inefficiency, and implementing cost-saving measures. This includes streamlining processes, leveraging technology to automate certain tasks, and adopting lean management practices to eliminate waste and improve overall operational efficiency.

Cass Information Systems Inc. has also focused on strategic procurement and vendor management to optimize its supply chain and reduce costs. By negotiating favorable terms with suppliers and leveraging economies of scale, the company has been able to achieve cost savings in areas such as technology procurement, equipment maintenance, and office supplies.

Furthermore, the company has implemented performance-based compensation structures and productivity enhancement programs to align employee incentives with cost-saving objectives. By rewarding employees for their contributions to cost reduction and efficiency improvement, Cass Information Systems Inc. has fostered a culture of productivity and cost-consciousness within the organization.

This image is property of static.seekingalpha.com.

Declining profit margins

Despite its challenges with weaker activity from operating clients and higher operating expenses, Cass Information Systems Inc. has experienced a decline in its profit margins. Profit margins are a critical measure of a company’s profitability, indicating the percentage of revenue that translates into profits after deducting all expenses.

The decline in profit margins can be primarily attributed to the combination of reduced revenue from weaker activity and higher operating expenses. With lower revenue and relatively fixed operating expenses, the company has experienced a decrease in its profitability. This has put pressure on Cass Information Systems Inc. to find innovative ways to improve its margins and ensure sustainable profitability.

Strategies to address declining profit margins

Cass Information Systems Inc. has implemented several strategies to address the declining profit margins. One such strategy is to focus on cost control and efficiency improvement across all aspects of its operations. By identifying cost-saving opportunities, minimizing waste, and optimizing processes, the company has been able to reduce its operating expenses and improve its profit margins.

Additionally, Cass Information Systems Inc. has explored opportunities to increase its revenue streams through diversification and expansion. By leveraging its expertise and technology, the company has identified new markets and industries where its services can add value. This has allowed the company to tap into previously untapped revenue sources, mitigating the adverse effects of declining profit margins.

Lastly, Cass Information Systems Inc. has prioritized investments in research and development to drive innovation and differentiate its offerings from competitors. By introducing new and enhanced services, the company has been able to command higher pricing and generate additional revenue, positively impacting its profit margins.

This image is property of static.seekingalpha.com.

Strong history of raising dividends

While Cass Information Systems Inc. has faced challenges in growing its bottom line, the company has a strong history of raising dividends. Dividends are a portion of a company’s profits that are distributed to its shareholders as a form of return on their investment. By consistently increasing its dividend payments, Cass Information Systems Inc. has demonstrated its commitment to shareholder value and has attracted investors seeking steady income streams.

The company’s track record of raising dividends is a testament to its ability to generate consistent cash flows and maintain a healthy financial position. Despite the challenges posed by weaker activity and declining profit margins, Cass Information Systems Inc. has managed to allocate a portion of its profits towards dividend payments. This indicates a level of stability and financial strength that is attractive to income-focused investors.

Importance of dividend policy

Dividend policy plays a crucial role in attracting investors and maintaining shareholder confidence. By consistently raising dividends, Cass Information Systems Inc. has positioned itself as a reliable and attractive investment option. Dividends provide a tangible return on investment to shareholders and are often seen as a reflection of a company’s financial health and long-term prospects.

Furthermore, a strong history of raising dividends can also positively impact the company’s stock price. Investors often value dividend-paying stocks more favorably due to the income potential they offer. As a result, the stock price of Cass Information Systems Inc. may be positively influenced by its dividend track record, enhancing the overall value and market perception of the company.

This image is property of static.seekingalpha.com.

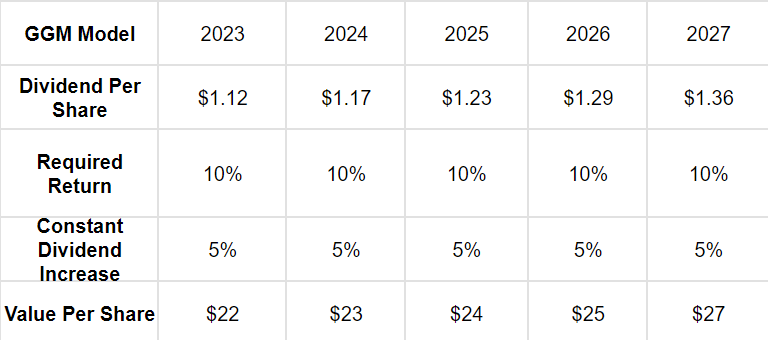

Overvaluation of the company

Despite its strong dividend history, there are concerns about the current valuation of Cass Information Systems Inc. Overvaluation refers to a situation where the market price of a stock exceeds its intrinsic value. In other words, the company’s stock may be trading at a higher price than what can be justified by its financial performance, growth prospects, and industry dynamics.

The overvaluation of Cass Information Systems Inc. could be due to various factors. First, market sentiment and investor optimism can sometimes lead to inflated stock prices, detached from fundamental valuation measures. This can create an unsustainable gap between the company’s stock price and its intrinsic value.

Second, the market may be pricing in overly optimistic growth expectations for Cass Information Systems Inc. While the company has a strong history and potential for growth, unrealistic expectations can drive the stock price to levels that may not be sustainable in the long run.

Lastly, the overvaluation could also be a result of speculative trading or market inefficiencies. Market participants may engage in short-term speculation, driving up the stock price without considering the underlying fundamentals of the company. These temporary market distortions can create an overvaluation scenario that may not be reflective of the company’s true value.

Implications of overvaluation

The overvaluation of Cass Information Systems Inc. carries several implications for both existing and potential investors. First, investors who buy the stock at an inflated price may be exposed to significant downside risk if the market corrects and the stock price reverts to its intrinsic value. This can result in substantial losses and erode the investment returns.

Second, the overvaluation can also impact the long-term performance of the stock. Over time, the stock price tends to revert to its intrinsic value based on the company’s financial performance and market conditions. As a result, an overvalued stock may experience a price correction, potentially leading to a decline in shareholder value.

Lastly, the overvaluation may deter new investors from entering the market or investing in Cass Information Systems Inc. High valuation multiples can make the stock less attractive, particularly for value-focused investors who prioritize buying stocks at a reasonable price relative to their intrinsic value. This can limit the demand for the stock and potentially impact its liquidity and trading volumes.

In conclusion, Cass Information Systems Inc. has faced a series of challenges that have impacted its financial performance. Weaker activity from operating clients, higher operating expenses, and declining profit margins have all contributed to the company’s growth limitations. However, Cass Information Systems Inc. has a strong history of raising dividends, indicating its commitment to shareholder value. Nonetheless, concerns about the current overvaluation of the company raise questions about the sustainability and attractiveness of its stock. Investors should carefully evaluate the company’s financials, growth prospects, and industry dynamics before making investment decisions.

This image is property of static.seekingalpha.com.