Vonovia SE, Europe’s leading residential real estate company, has experienced a decline in valuation recently; however, it still presents an exceptional opportunity for investors with triple-digit upside potential. With a solid rental business and strong financials, investing in Vonovia through an international broker like IBKR is highly recommended. Boasting over half a million residential units and managing over 70,000 apartments across Europe, Vonovia has showcased significant rental EBITDA growth, high occupancy rates, and efficient operations. Furthermore, the company’s financial maturities are well-covered, accompanied by strong credit ratings. Although its valuation has experienced a setback, market stabilization is anticipated, and the stock presents the potential for triple-digit growth, with a target price of €48 per share. Offering appealing value as one of Europe’s most promising real estate companies, Vonovia is undoubtedly a strategic “BUY” with a target price target of €48 per share.

This image is property of static.seekingalpha.com.

Vonovia SE: Decline in Valuation with Triple-Digit Upside Potential

Introduction

Vonovia SE, Europe’s leading residential real estate company, has recently experienced a decline in its valuation. However, despite this temporary setback, there is significant upside potential for investors willing to capitalize on the company’s strong fundamentals. This article aims to provide an in-depth analysis of Vonovia, its financial performance, operational strengths, and the factors influencing its valuation. Furthermore, it will offer recommendations on investing in Vonovia through an international broker, with a focus on IBKR.

Investing in Vonovia through an International Broker

To maximize the benefits and opportunities associated with investing in Vonovia, it is recommended to utilize the services of an international broker. This approach provides investors with access to a wider range of investment options and allows them to diversify their portfolios across borders. One such international broker, IBKR, stands out as a reliable and established platform for investing in global markets. With its extensive range of products, competitive pricing, and advanced trading tools, IBKR offers a seamless investment experience for individuals seeking exposure to Vonovia and other international assets.

Overview of Vonovia

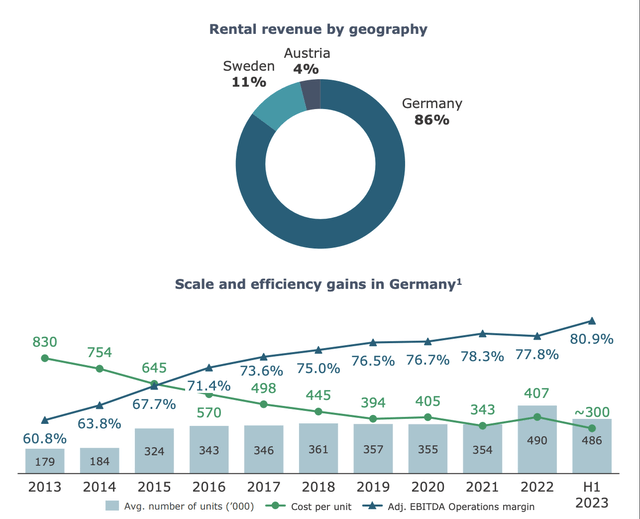

As Europe’s leading residential real estate company, Vonovia boasts a significant presence and influence in the sector. The company manages over half a million residential units across Europe, with a substantial portfolio of over 70,000 apartments. Vonovia’s solid rental business, coupled with its strong financials, positions it as a reliable investment opportunity for those looking for stability and long-term growth in the real estate market.

This image is property of static.seekingalpha.com.

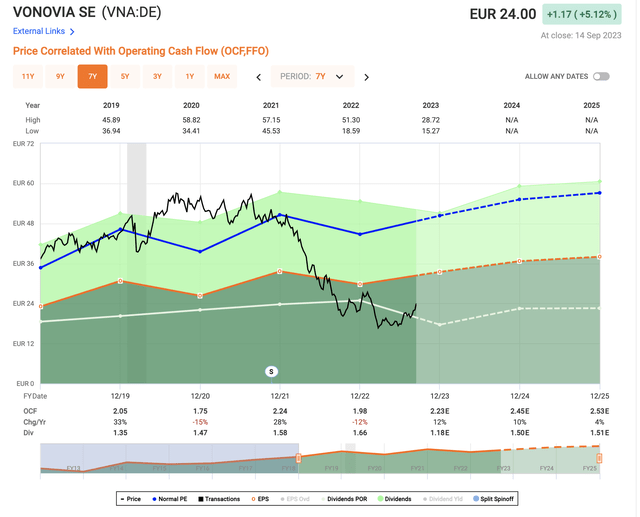

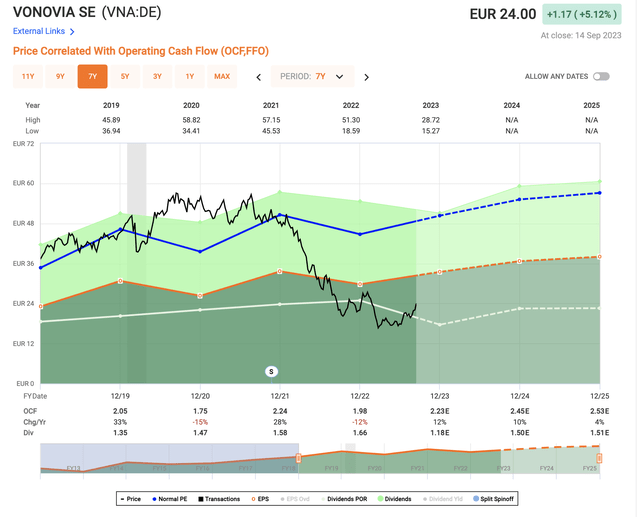

Financial Overview of Vonovia

Vonovia’s financial performance has been commendable, with its financial maturities well-covered and strong credit ratings. Furthermore, the company has demonstrated significant growth in rental earnings before interest, taxes, depreciation, and amortization (EBITDA). This robust performance can be attributed to the high occupancy rates and efficient operations maintained by Vonovia. These financial indicators reflect the company’s operational excellence and its ability to generate substantial revenue streams.

Operational Strengths

The management of residential units is one of Vonovia’s key strengths, as evidenced by its efficient operations. The company implements strategic initiatives to optimize the use of its assets, ensuring minimal vacancies and maximizing rental income. This approach has contributed to Vonovia’s strong revenue generation, enabling it to reinvest in property upgrades and expansions. By continuously improving and expanding its portfolio, Vonovia ensures long-term value creation for its shareholders.

This image is property of static.seekingalpha.com.

Factors Affecting Vonovia’s Valuation

Several factors influence the valuation of Vonovia, including market conditions, real estate trends, competition, and macroeconomic and political factors. The real estate market is subject to fluctuations, and Vonovia’s valuation is sensitive to changes in supply and demand dynamics. Competition within the real estate sector can impact the company’s market share and profitability. Additionally, macroeconomic factors, such as interest rates and government policies, can have a significant influence on the overall valuation of Vonovia and the real estate market as a whole.

Expected Stabilization in the Market

Despite the recent decline in Vonovia’s valuation, market trends suggest a potential stabilization in the near future. As economies recover from the impact of the global pandemic, the real estate sector is expected to rebound, presenting opportunities for growth. Vonovia’s strong fundamentals, coupled with its effective management and strategic positioning, positions the company to benefit from this expected stabilization. Investors who anticipate the market’s recovery can potentially capitalize on the upside potential of Vonovia’s stock.

This image is property of static.seekingalpha.com.

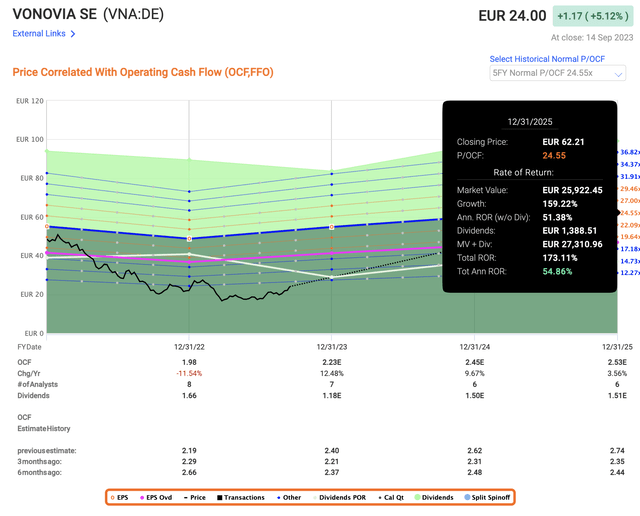

Triple-Digit Upside Potential

Vonovia presents investors with an attractive triple-digit upside potential. This estimation is based on multiple factors, including the company’s strong financial performance, operational strengths, and the expected stabilization of the real estate market. By considering these factors, investors can make informed decisions and evaluate the potential return on investment. Furthermore, when compared to its competitors, Vonovia stands out as one of the most appealingly valued real estate companies in Europe. This comparative advantage further enhances the triple-digit growth potential for Vonovia’s stock.

Valuation of Vonovia

Considering the factors mentioned above, analysts project a target price of €48 per share for Vonovia. This valuation takes into account the company’s financial performance, operational strengths, market conditions, and the potential for future growth. With the current stock price below this target, there is a notable opportunity for investors to benefit from the undervaluation of Vonovia’s shares.

This image is property of images.pexels.com.

Recommendation: Buy Vonovia Shares

Considering Vonovia’s solid position in the European real estate market, its strong financials, and the significant upside potential, it is recommended to buy Vonovia shares. The expected stabilization of the real estate market, coupled with Vonovia’s operational excellence, positions the company for growth in the long term. Moreover, with a target price of €48 per share and the current undervaluation, investors have an opportunity to realize substantial returns on their investment. Therefore, for those seeking exposure to the real estate sector with a professional and positive outlook, buying Vonovia shares is the recommended course of action.