In the ever-evolving landscape of the financial technology industry, a multitude of innovations and trends are shaping the future of fintech. From blockchain technology to artificial intelligence, these advancements are revolutionizing the way we bank, invest, and conduct financial transactions. This article explores the cutting-edge developments that are propelling the fintech industry forward, highlighting the transformative potential they hold for both businesses and consumers alike. By examining the latest trends in fintech, we gain valuable insights into the future direction of this dynamic and rapidly growing field.

This image is property of images.unsplash.com.

The Rise of Fintech

Emergence of Fintech Startups

In recent years, there has been a significant rise in the number of fintech startups, revolutionizing the financial industry with innovative technological solutions. These startups have leveraged the power of technology to provide financial services in a more efficient, accessible, and cost-effective manner. By utilizing advanced technologies such as artificial intelligence (AI), machine learning (ML), and blockchain, fintech startups have disrupted traditional financial institutions and introduced new business models to cater to the evolving needs of consumers.

Disruption of Traditional Financial Institutions

Traditional financial institutions such as banks and insurance companies have faced unprecedented disruption due to the emergence of fintech. Fintech companies have challenged the status quo by offering faster, more convenient, and personalized financial services. By leveraging technology, fintech startups have been able to streamline processes, reduce costs, and provide innovative products and services that were previously only offered by traditional institutions. The rise of fintech has forced traditional financial institutions to adapt and transform their operations to remain competitive in this rapidly evolving landscape.

Increased Investment in Fintech

As the fintech industry continues to gain momentum and reshape the financial landscape, there has been a significant increase in investment in fintech startups. Venture capital firms, institutional investors, and even traditional financial institutions have recognized the potential of fintech and are actively investing in these innovative companies. The influx of capital has fueled the growth of fintech startups, allowing them to further develop their products, expand their customer base, and drive technological advancements in the financial industry. This increased investment in fintech is a testament to the growing confidence in the sector and its potential to redefine the future of finance.

Advancements in Artificial Intelligence and Machine Learning

Automated Financial Advisory Services

AI and ML have transformed the way financial advisory services are offered. These advancements have enabled the development of robo-advisors, automated platforms that provide personalized investment advice based on algorithms and data analysis. Robo-advisors have democratized access to financial advice, making it more affordable and accessible to a broader segment of the population. By leveraging AI and ML algorithms, robo-advisors can analyze vast amounts of data to generate investment recommendations tailored to each individual’s risk profile, goals, and preferences.

Improved Fraud Detection

The increased adoption of AI and ML in fintech has significantly enhanced fraud detection capabilities. Traditional fraud detection methods often rely on predefined rule sets, which are limited in their ability to identify new and evolving fraud patterns. With AI and ML, fraud detection systems can continuously learn and adapt to changing fraud tactics, improving their detection rates and reducing false positives. By analyzing patterns, anomalies, and behavioral data, AI-powered fraud detection systems can identify suspicious activities in real-time, allowing financial institutions to take proactive measures to prevent fraud and protect their customers.

Enhanced Customer Service

AI and ML technologies have also revolutionized customer service in the financial industry. Chatbots and virtual assistants powered by AI are being deployed by fintech companies to provide instant and personalized customer support. These intelligent virtual assistants can handle routine customer queries, provide 24/7 support, and even assist with complex financial transactions. By leveraging natural language processing (NLP) and machine learning algorithms, these virtual assistants can understand customer inquiries, provide accurate responses, and continuously improve their performance based on user interactions. This enables fintech companies to deliver seamless, efficient, and personalized customer service experiences.

Blockchain Technology in Fintech

Promoting Secure and Transparent Transactions

Blockchain technology has emerged as a game-changer in the fintech industry, offering secure and transparent transactions. By utilizing a distributed ledger, blockchain eliminates the need for intermediaries and provides a decentralized system for recording and verifying transactions. This enhances security, as transactions are encrypted and stored across multiple nodes, reducing the risk of data tampering or unauthorized access. Additionally, blockchain enables transparent transactions, as all participants can view and verify the transaction history, promoting trust and accountability in the financial ecosystem.

Streamlining Cross-Border Payments

Cross-border payments have traditionally been slow, expensive, and burdened by intermediaries. Blockchain technology has the potential to streamline cross-border payments, eliminating the need for multiple intermediaries and reducing transaction costs. By leveraging blockchain, fintech companies can facilitate peer-to-peer transactions, bypassing the traditional correspondent banking system. This enables faster settlements, lower fees, and improved transparency in cross-border transactions, benefitting businesses and individuals alike.

Enabling Decentralized Finance

Blockchain technology has also paved the way for decentralized finance (DeFi), a rapidly growing sector within the fintech industry. DeFi aims to recreate traditional financial services and products using blockchain technology, eliminating the need for intermediaries such as banks. DeFi platforms enable peer-to-peer lending, decentralized exchanges, and other financial services, providing individuals with greater control over their finances. By leveraging smart contracts and blockchain networks, DeFi platforms offer transparency, security, and accessibility, making financial services more inclusive and empowering individuals to take control of their financial future.

Mobile Payments and Digital Wallets

Convenience and Accessibility

Mobile payments and digital wallets have become increasingly popular, enabling consumers to make secure and convenient transactions using their smartphones. Fintech companies have developed mobile payment solutions that allow users to make payments, transfer funds, and manage their finances on the go. With the widespread adoption of smartphones, mobile payments offer a seamless and convenient alternative to traditional payment methods. By simply tapping their smartphones or scanning QR codes, users can complete transactions quickly and efficiently, without the need for physical cash or cards.

Integration with IoT Devices

The integration of mobile payments with Internet of Things (IoT) devices has further expanded the scope of fintech. IoT devices, such as smartwatches and connected cars, can now be used as payment devices, allowing users to make transactions without the need for a smartphone or physical card. This integration of mobile payments with IoT devices offers a frictionless and connected payment experience, enabling users to make payments effortlessly, even in unconventional settings. Whether it’s ordering groceries from a smart refrigerator or paying for parking using a connected car, mobile payments integrated with IoT devices are transforming the way we transact.

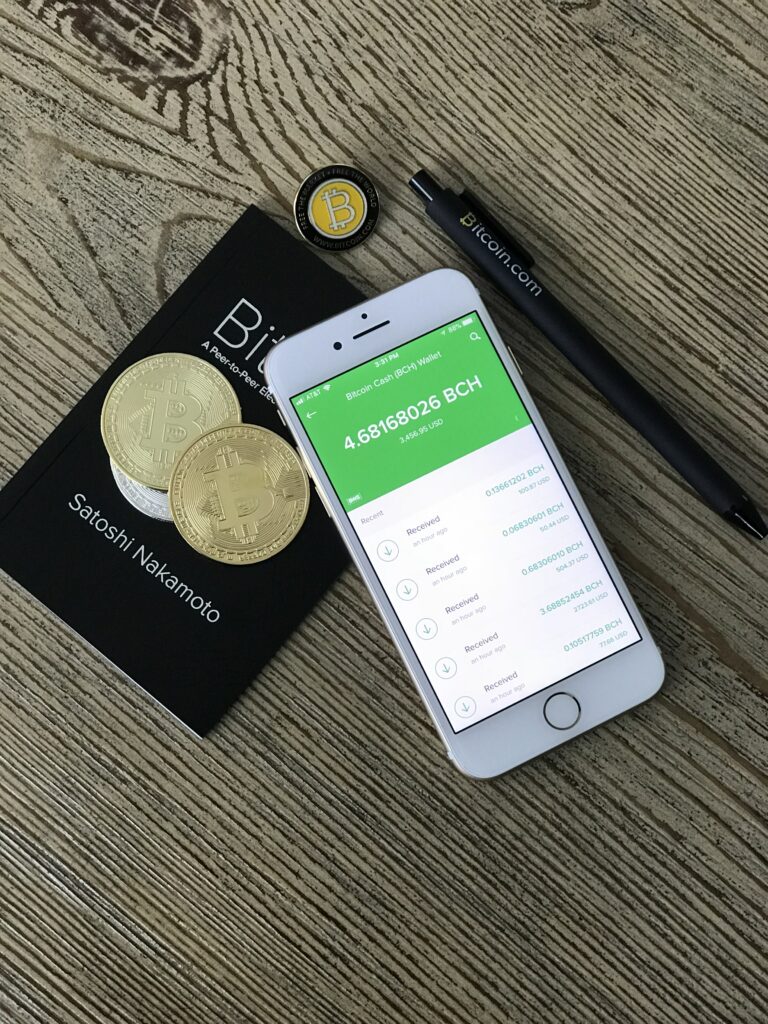

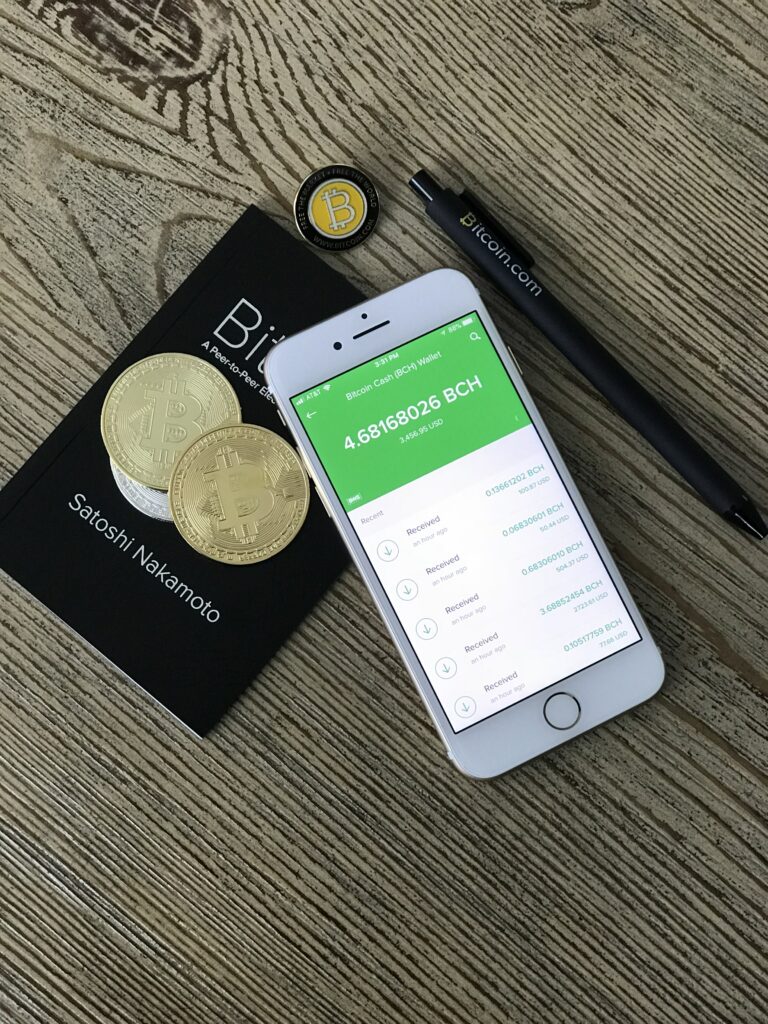

Virtual Currency Adoption

Fintech has also played a significant role in driving the adoption of virtual currencies, such as Bitcoin and other cryptocurrencies. Virtual currencies offer a decentralized and borderless alternative to traditional fiat currencies, enabling fast and low-cost international transactions. Fintech companies have developed digital wallets and platforms that allow users to securely store, manage, and transact in virtual currencies. The adoption of virtual currencies has the potential to reshape the global financial system, offering users increased financial sovereignty, financial inclusion, and opportunities for investment and growth.

This image is property of images.unsplash.com.

Regulatory Challenges and Compliance

Addressing Data Privacy and Security

With the rapid advancement of fintech, data privacy and security have become critical concerns. Fintech companies handle vast amounts of sensitive customer data, including personal and financial information. It is imperative for these companies to prioritize data privacy and security to instill trust in their customers. Strict security measures, such as data encryption, secure networks, and multifactor authentication, must be implemented to safeguard customer data from potential breaches. Additionally, complying with data protection regulations, such as the General Data Protection Regulation (GDPR), ensures that customer data is collected, stored, and processed in a lawful and transparent manner.

Navigating through Regulatory Frameworks

Fintech companies operate in a highly regulated environment, and navigating through regulatory frameworks can be a complex and challenging process. Compliance with financial regulations, such as know-your-customer (KYC) and anti-money laundering (AML) requirements, is crucial to mitigate the risk of financial crimes and maintain the integrity of the financial system. Fintech companies must invest in robust compliance programs, partnering with legal and regulatory experts to ensure adherence to regulatory requirements. This proactive approach enables fintech companies to build trust with regulators, investors, and customers, ensuring long-term sustainability and growth.

Ensuring Ethical Use of AI

The ethical use of AI in fintech is another important consideration. As AI technologies continue to advance, concerns regarding bias, discrimination, and data privacy arise. Fintech companies must ensure that AI algorithms are fair, transparent, and free from inherent biases to provide equitable financial services. Additionally, robust data governance frameworks should be established to protect consumer privacy and ensure responsible use of customer data. Collaborating with industry stakeholders, policymakers, and regulatory bodies can help establish ethical guidelines and frameworks that empower the ethical use of AI in the fintech industry.

Open Banking and API Economy

Connecting Financial Institutions and Third-Party Providers

Open banking has emerged as a transformative trend in the fintech industry, enabling financial institutions to share customer data securely with third-party providers. Through the use of application programming interfaces (APIs), financial institutions can grant access to customer data to authorized third-party providers, facilitating the development of innovative financial products and services. Open banking fosters competition, encourages collaboration, and promotes customer-centric solutions by allowing customers to share their financial information with multiple providers, enabling personalized and tailored financial services.

Enabling Seamless Financial Services

The API economy has paved the way for seamless financial services, allowing for the integration of various financial products and services into a single platform or application. Fintech companies can leverage APIs to connect with different financial institutions and aggregate financial data, enabling customers to view their entire financial picture in one place. This integration and data sharing streamline processes, provide users with a centralized hub for managing their finances, and enable the development of personalized financial solutions. The API economy offers increased convenience, efficiency, and choice to consumers, empowering them to take control of their financial well-being.

Enhancing Financial Inclusion

Open banking and the API economy have the potential to enhance financial inclusion, providing access to financial services for underserved populations. By enabling the sharing of customer data across institutions, fintech companies can utilize this information to assess creditworthiness and offer tailored financial products to individuals with limited credit history. Open banking also allows fintech companies to develop innovative products and services specifically targeted at the unbanked and underbanked populations, addressing their unique financial needs and promoting financial inclusion on a global scale.

This image is property of images.unsplash.com.

Biometric Authentication

Enhanced Security and Fraud Prevention

Biometric authentication methods, such as fingerprint, facial recognition, and voice recognition, have significantly enhanced security and fraud prevention in the fintech industry. Biometric data is unique to individuals and difficult to replicate, making it a reliable and secure method for authentication. By utilizing biometrics, fintech companies can ensure that only authorized individuals have access to financial accounts and sensitive information. Biometric authentication adds an extra layer of security, mitigating the risk of identity theft, fraud, and unauthorized access to financial assets.

Improved User Experience

Biometric authentication not only enhances security but also improves the user experience in the fintech industry. Traditional authentication methods, such as passwords and PINs, can be cumbersome and prone to human error. Biometric authentication eliminates the need for users to remember complex passwords or carry physical authentication tokens, making the authentication process more convenient and seamless. With a simple touch or glance, users can securely access their financial accounts and perform transactions, enhancing user satisfaction and engagement with fintech platforms.

Adoption in Identity Verification

Biometric authentication has found wide adoption in identity verification processes. Fintech companies can leverage biometrics to verify the identity of customers during onboarding, ensuring the authenticity of user information. Biometric identity verification provides a more robust and reliable method compared to traditional identity verification methods, such as document checks or knowledge-based questions. By incorporating biometrics into identity verification processes, fintech companies can prevent identity fraud, improve regulatory compliance, and provide a secure and seamless user experience.

Robotic Process Automation

Efficiency and Cost Reduction

Robotic process automation (RPA) has emerged as a powerful tool in the fintech industry, enabling the automation of repetitive and rule-based tasks. RPA software can mimic human actions and interact with applications, systems, and data, performing tasks more efficiently and accurately than humans. By automating manual processes, fintech companies can significantly reduce operational costs and free up resources for more value-added activities. RPA enhances process efficiency, reduces errors, and ensures compliance with predefined rules and regulations, driving operational excellence in the financial industry.

Automating Repetitive Tasks

Fintech companies handle a multitude of repetitive tasks, such as data entry, document processing, and transaction reconciliation. These tasks are time-consuming, prone to errors, and often require significant human effort. RPA enables the automation of these repetitive tasks, allowing software robots to handle them quickly and accurately. By automating these tasks, fintech companies can improve operational efficiency, reduce processing times, and allocate human resources to more complex and strategic activities that require critical thinking and decision-making.

Improving Accuracy in Financial Processes

One of the key advantages of RPA in the fintech industry is its ability to improve accuracy in financial processes. Humans can make errors due to fatigue, distractions, or manual data entry, leading to costly mistakes in financial transactions. RPA eliminates the risk of human error by ensuring consistent and accurate data processing. Software robots can validate data, perform calculations, and reconcile accounts more accurately and efficiently than humans. This improved accuracy not only reduces the risk of financial errors but also enhances regulatory compliance and customer satisfaction.

Insurtech Innovations

Personalized Insurance Solutions

Insurtech, a subset of fintech focused on the insurance industry, has introduced personalized insurance solutions that cater to individual needs and preferences. By leveraging AI, ML, and big data analytics, insurtech companies can analyze vast amounts of data to assess risk profiles, determine appropriate coverage, and offer personalized insurance quotes. This data-driven approach enables customers to obtain insurance plans tailored to their specific requirements, resulting in more accurate pricing, improved risk management, and increased customer satisfaction.

Digital Claims Processing

Insurtech has transformed the traditionally lengthy and complex claims processing procedures into efficient and customer-friendly experiences. Through the use of digital technology and automation, insurtech companies can streamline the claims process, reducing paperwork, minimizing manual intervention, and accelerating claim settlements. By leveraging AI algorithms and image recognition technology, insurtech platforms can automate claims assessment, fraud detection, and decision-making, significantly reducing the time and effort required for claims processing. This digitization of the claims process enhances operational efficiency, improves customer experience, and increases transparency in the insurance industry.

Usage-Based Insurance

Usage-based insurance (UBI), a concept introduced by insurtech companies, enables policyholders to pay premiums based on their actual usage of vehicles, property, or other insured assets. By leveraging IoT devices, telematics, and data analytics, UBI allows insurance providers to offer personalized insurance plans that reflect the individual’s behavior, driving habits, or usage patterns. UBI encourages safer behaviors, rewards low-risk individuals with lower premiums, and provides a fairer pricing model compared to traditional insurance plans. Insurtech has transformed the insurance industry by making insurance coverage more accessible, flexible, and affordable for consumers.

The Integration of Fintech and E-commerce

Seamless Online Payments

The integration of fintech and e-commerce has simplified online payment processes, providing consumers with seamless and secure payment solutions. Fintech companies have developed payment gateways, e-wallets, and digital payment systems that enable users to make instant and secure transactions on e-commerce platforms. By eliminating the need to enter credit card details for every purchase, fintech solutions have enhanced the convenience and speed of online payments. This integration has contributed to the growth of e-commerce by offering a frictionless payment experience, reducing cart abandonment rates, and improving customer satisfaction.

Digital Lending Platforms

Fintech has revolutionized the lending landscape by introducing digital lending platforms, which leverage technology to facilitate the borrowing process. These platforms connect borrowers to lenders through online marketplaces, streamlining loan origination, underwriting, and disbursement. By utilizing AI algorithms and big data analytics, fintech lending platforms can assess creditworthiness, automate credit scoring, and expedite loan approvals, making the lending process faster, more efficient, and accessible to a wider range of borrowers. This integration of fintech and e-commerce has democratized access to credit, empowering individuals and small businesses to obtain financing in a convenient and transparent manner.

Data-Driven Customer Insights

The integration of fintech and e-commerce has generated a wealth of data that can be leveraged to gain actionable insights into consumer behavior. By analyzing transactional data, browsing patterns, and customer preferences, fintech companies can generate valuable customer insights that enable personalized marketing and product recommendations. These insights empower e-commerce businesses to tailor their offerings, improve customer targeting, and optimize customer experiences, ultimately driving customer satisfaction and increasing sales. The integration of fintech and e-commerce has unlocked the potential of data-driven marketing, enabling businesses to drive growth and stay ahead in a highly competitive digital marketplace.

In conclusion, the rise of fintech has disrupted the traditional financial landscape, introducing innovative solutions that leverage technology to deliver enhanced financial services. Advancements in AI and ML have revolutionized advisory services, fraud detection, and customer service in the fintech industry. On the other hand, blockchain technology has promoted secure and transparent transactions and enabled decentralized finance. Mobile payments, biometric authentication, robotic process automation, insurtech innovations, open banking, and the integration of fintech and e-commerce have further transformed the way we transact, manage our finances, and access financial services. However, these technological advancements also pose regulatory challenges that need to be addressed to ensure data privacy, compliance, and ethical use of AI. The future of fintech is undoubtedly promising, with ongoing innovations and trends shaping the financial industry for years to come.