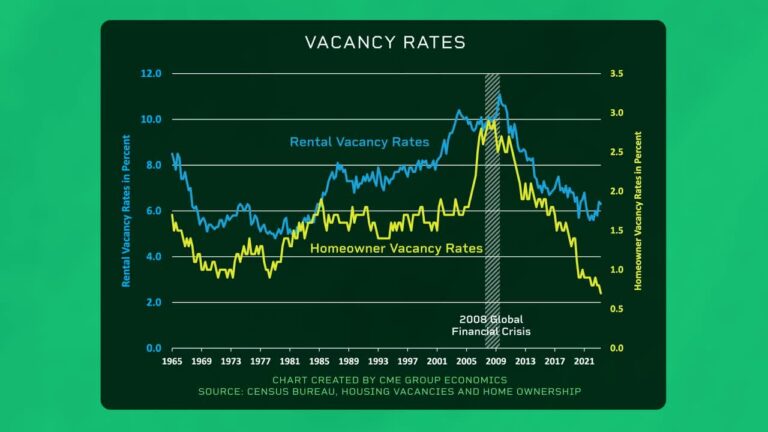

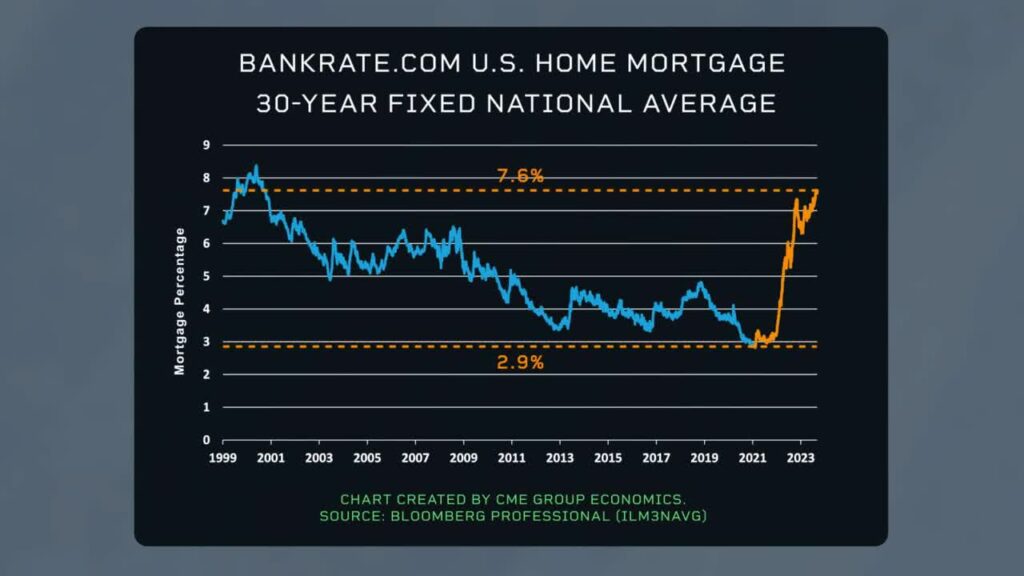

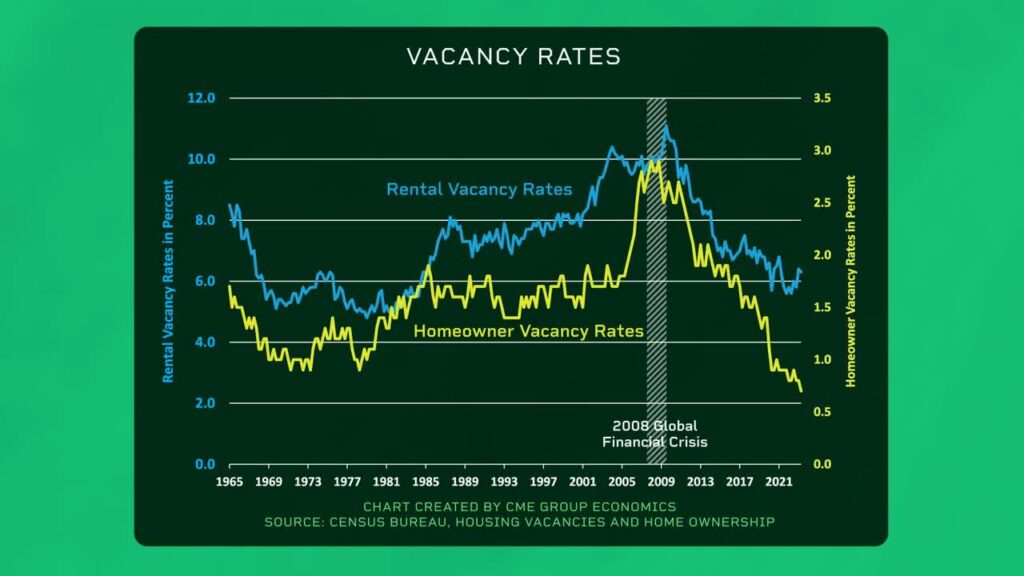

The housing market is facing significant challenges due to record-high interest rates and low vacancy rates. Mortgage rates have climbed above 7%, the highest in two decades, resulting in a decrease in the number of new mortgages being issued. However, unlike the period leading up to the global financial crisis in 2008, vacancy rates are extremely low. Currently, only 6.4% of rental properties and 0.7% of owner-occupied properties are vacant, marking a significant difference compared to the pre-crisis levels. While home prices have stopped rising, they are not yet collapsing, as rental costs have increased due to higher rates. These factors suggest a potential impact on the housing market, raising the question of whether it will crash like it did in 2008.

The Impact of Record-Low Vacancy Rates

Low vacancy rates contribute to rising rental costs

Record-low vacancy rates in the housing market have contributed to a significant rise in rental costs. With a limited supply of available rental properties, the high demand has allowed landlords to increase rental prices. This has made it increasingly difficult for individuals and families to find affordable rental housing, putting a strain on their budget and overall financial well-being.

Demand for rental properties remains high

Despite the rising rental costs, the demand for rental properties continues to be high. Many individuals and families are unable to afford purchasing a home, either due to the high prices or the inability to qualify for mortgage loans. As a result, they rely on the rental market to meet their housing needs. This sustained demand fuels the competition for available rental properties and contributes to the low vacancy rates.

Limited supply of available housing

One of the key factors driving the record-low vacancy rates is the limited supply of available housing. This shortage of housing options creates a highly competitive market, where potential renters are often faced with limited choices and are willing to pay higher prices to secure a rental property. The lack of new construction and slow pace of development further exacerbate the housing shortage, making it even more challenging for individuals and families to find suitable housing.

Increased competition among homebuyers

The high demand for rental properties is not only driven by the limited supply but also by the increased competition among homebuyers. With rising home prices and high interest rates, many individuals and families are unable to enter the housing market as homeowners. This pushes them to continue renting, further intensifying the competition for available rental properties.

Higher demand for rental properties

The combination of limited supply, high rental costs, and increased competition among homebuyers has resulted in a higher demand for rental properties. As more individuals and families opt for renting rather than buying, the rental market experiences increased pressure. Landlords and property owners have the opportunity to capitalize on this demand, leading to rental prices that are often out of reach for many individuals and families.

Impact on housing affordability

The impact of record-low vacancy rates goes beyond the rising rental costs. It has a significant effect on housing affordability as a whole. With limited housing options and high rental prices, individuals and families with lower incomes are finding it increasingly challenging to afford suitable housing. This can lead to housing instability, overcrowding, and a decrease in overall living standards for those who are unable to find affordable housing options.

Effects of High Interest Rates

Decreased affordability for homebuyers

High interest rates have a direct impact on the affordability of homeownership. As interest rates increase, the cost of borrowing also increases. This means that potential homebuyers will need to allocate a larger portion of their income towards mortgage payments, making it more difficult for them to qualify for a mortgage loan or afford a higher-priced property.

Potential decrease in home sales

The combination of high interest rates and decreased affordability can potentially lead to a decrease in home sales. As the cost of borrowing becomes more expensive, potential homebuyers may reconsider their decision to purchase a home or delay their plans altogether. This decrease in demand for homeownership can have a ripple effect on the overall housing market.

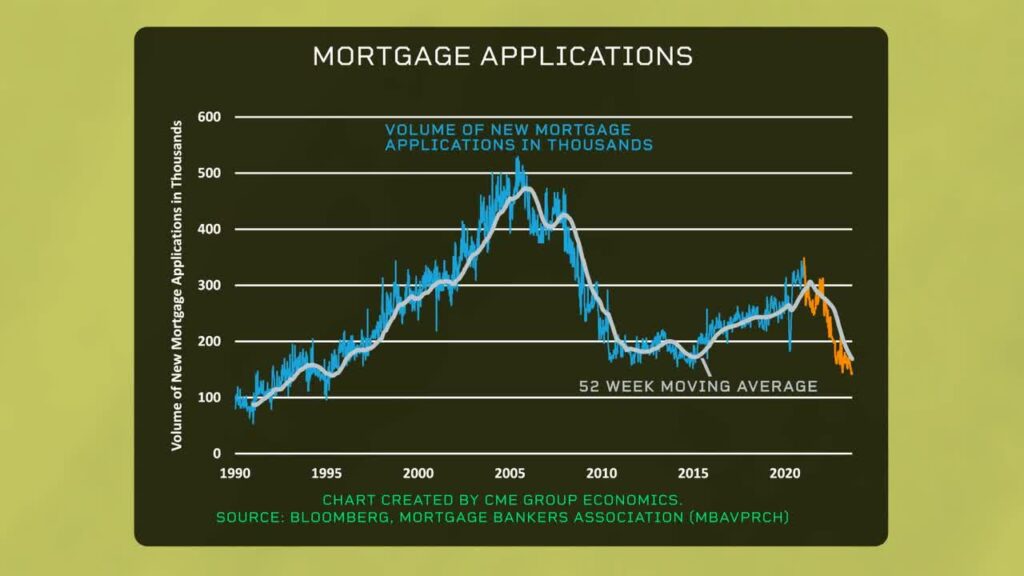

Lower demand for new mortgages

The rise in interest rates has resulted in a lower demand for new mortgages. As potential homebuyers face higher borrowing costs, they may choose to postpone their plans to apply for a mortgage loan. This decrease in demand can impact the mortgage industry, with lenders experiencing a decline in new mortgage applications and originations.

Impact on mortgage refinancing

High interest rates can also have an impact on mortgage refinancing. Homeowners who were considering refinancing their mortgages to take advantage of lower interest rates may find themselves deterred by the higher rates. This can result in a slowdown in refinancing activity, limiting homeowners’ ability to reduce their mortgage payments or access equity in their homes.

Increased cost of borrowing

High interest rates translate to an increased cost of borrowing for homebuyers. This impacts not only the monthly mortgage payments but also the overall affordability of homeownership. As borrowing costs rise, potential buyers may need to adjust their budgets and financial plans to accommodate the higher expenses associated with purchasing a home.

Potential decrease in housing construction

The higher interest rates can also have an impact on housing construction. As borrowing costs increase, developers and builders may face challenges in financing new construction projects. This can result in a slowdown in housing construction, further exacerbating the shortage of available housing and contributing to the low vacancy rates.

This image is property of static.seekingalpha.com.

Factors Contributing to Record-Low Vacancy Rates

Tightening rental market

The tightening rental market is a significant factor contributing to the record-low vacancy rates. With limited supply and high demand, rental properties are in high demand, leading to reduced vacancy rates. Landlords and property owners are able to maintain high occupancy rates and increase rental prices due to the scarcity of available rental properties.

Strong economic conditions

Strong economic conditions can also contribute to record-low vacancy rates. When the economy is doing well and people have stable employment and income, they are more likely to seek housing, whether through renting or homeownership. This increased demand for housing, coupled with limited supply, can drive vacancy rates down.

Shift in homeownership trends

A shift in homeownership trends can impact vacancy rates. In recent years, there has been a shift towards renting rather than owning a home. This shift can be attributed to various factors, such as changing demographics, financial constraints, or lifestyle preferences. As more individuals and families opt for renting, the demand for rental properties increases, leading to lower vacancy rates.

Population growth and migration

Population growth and migration can also contribute to record-low vacancy rates. In areas experiencing significant population growth or attracting a large number of migrants, the demand for housing increases. This can put additional pressure on the rental market, leading to lower vacancy rates as the supply struggles to keep up with the demand.

Slow pace of new construction

The slow pace of new construction is a contributing factor to low vacancy rates. With limited new housing stock entering the market, the existing supply of rental properties is not able to keep up with the demand. This imbalance between supply and demand leads to lower vacancy rates, benefiting landlords and property owners.

Challenges and Opportunities for Homebuyers

Limited housing options

One of the challenges faced by homebuyers in the current housing market is the limited housing options. With low vacancy rates and increased competition, potential buyers may struggle to find a suitable property within their desired location and budget. This limited selection can impact their ability to find a home that meets their needs and preferences.

Rising home prices

Another challenge for homebuyers is the rising home prices. As demand continues to outpace supply, home prices have been steadily increasing. This makes it more difficult for potential buyers to afford a home, especially for those with lower incomes or limited financial resources. The rising home prices can limit the options available to homebuyers and potentially price them out of the market.

Increased competition

The high demand for housing has resulted in increased competition among homebuyers. Multiple offers on properties, bidding wars, and limited negotiating power have become common in this competitive market. Homebuyers may need to act quickly and be prepared to make competitive offers to secure a property.

Need for creative financing

Given the challenges faced by homebuyers, there is a need for creative financing options. This includes exploring alternative loan programs, down payment assistance programs, or working with lenders who offer flexible financing solutions. Homebuyers may need to think outside the box to overcome the financial barriers and make homeownership more accessible.

Exploring alternative housing options

In light of the challenges in the current housing market, homebuyers may need to explore alternative housing options. This includes considering different types of properties, such as townhouses, condos, or fixer-uppers, as well as exploring different neighborhoods or areas that may offer more affordable options. Flexibility and open-mindedness can be crucial in finding a suitable home in a competitive market.

This image is property of static.seekingalpha.com.

Implications for Real Estate Investors

Strong rental market

The record-low vacancy rates present real estate investors with opportunities in the rental market. With high demand and limited supply, rental properties can provide a steady stream of income for investors. The favorable market conditions can make rental property investments attractive, especially in desirable locations or areas experiencing population growth.

Opportunities for rental property investments

Real estate investors can capitalize on the strong rental market by investing in rental properties. The high demand and low vacancy rates create an environment where rental properties can generate consistent rental income and potential appreciation in value. Investors can consider acquiring properties to add to their rental portfolio and leverage the favorable market conditions.

Potential for higher rental income

The limited supply and high demand for rental properties can potentially result in higher rental income for real estate investors. With fewer vacancies and increased competition among renters, investors can command higher rental prices. This can lead to improved cash flow and higher returns on investment for those who own and manage rental properties.

Demand for affordable housing

Real estate investors can also focus on providing affordable housing options in the market. With rising housing costs and limited affordability, there is a need for rental properties that cater to individuals and families with lower incomes. Investors who can offer affordable housing options may benefit from increased demand and stable tenancies.

Considerations for property management

As real estate investors navigate the rental market, it is crucial to consider effective property management practices. With high demand and competitive market conditions, maintaining tenant satisfaction, addressing maintenance needs promptly, and ensuring proper property upkeep can contribute to long-term success in the rental market. Investors should also stay informed about local market trends and regulations to make informed decisions regarding their rental properties.

Government Intervention and Policy Considerations

Addressing affordability issues

The government plays a crucial role in addressing housing affordability issues. Various policy measures can be implemented to make homeownership more accessible and affordable, such as down payment assistance programs, first-time homebuyer incentives, or tax credits for homebuyers. Additionally, initiatives to increase the supply of affordable housing can help alleviate the affordability challenges faced by individuals and families.

Promoting homeownership

Government intervention can also focus on promoting homeownership. This can include initiatives to educate potential homebuyers, provide resources for homebuyer assistance, or offer favorable financing options. By promoting homeownership, the government can help individuals and families build equity and wealth through property ownership.

Supporting the rental market

Given the high demand for rental properties, the government can implement policies to support the rental market. This can include regulations to protect tenants’ rights, encourage the development of affordable rental housing, or provide incentives for landlords and property owners. A well-supported rental market can contribute to housing stability for individuals and families who rely on renting.

Encouraging housing construction

To address the shortage of available housing, the government can encourage and incentivize housing construction. This can be achieved by streamlining the permitting process, offering financial incentives to builders and developers, or implementing policies that prioritize the development of affordable housing units. By stimulating housing construction, the government can help alleviate the supply-demand imbalance in the housing market.

Regulating interest rates

Interest rates play a significant role in the affordability of homeownership and the overall housing market. The government, through monetary policy, can regulate interest rates to ensure they remain at a level that supports homeownership and economic growth. By monitoring and adjusting interest rates, the government can influence borrowing costs and create a more favorable environment for potential homebuyers.

This image is property of static.seekingalpha.com.

The Role of Mortgage Rates

Historical context of mortgage rates

Understanding the historical context of mortgage rates is essential in analyzing their impact on the housing market. Mortgage rates have fluctuated over time, influenced by various factors, including economic conditions, inflation, and monetary policy. By examining past trends, analysts can gain insights into the potential implications of current and future mortgage rate changes.

Relationship between high interest rates and housing market

High mortgage rates can have a direct impact on the housing market. As borrowing costs increase, potential homebuyers may face challenges in affording a home, resulting in decreased demand for homeownership. This can lead to decreased home sales, slower housing market activity, and potential stagnation or decline in home prices.

Impact of inflation on mortgage rates

Inflation can influence mortgage rates. When inflation is high, central banks may raise interest rates to combat rising prices. Higher mortgage rates reflect the increased borrowing costs associated with higher interest rates. Conversely, low inflation or deflationary pressures can result in lower mortgage rates, potentially stimulating housing market activity.

Homebuyer response to rising rates

Homebuyer behavior can be influenced by rising mortgage rates. As rates increase, potential buyers may choose to delay their homebuying plans, opt for smaller or more affordable properties, or reevaluate their budgets. Rising rates can create uncertainty and caution among homebuyers, leading to changes in their purchasing decisions and preferences.

Comparing the Current Housing Market to the 2008 Financial Crisis

Differences in vacancy rates

One notable difference between the current housing market and the period leading up to the 2008 financial crisis is the vacancy rates. Today, vacancy rates are significantly lower, indicating a tighter housing market. In contrast, the pre-crisis era had higher vacancy rates, pointing to an oversupply of housing.

Less exposure to subprime mortgages

Another difference is the reduced exposure to subprime mortgages in the current housing market. Prior to the 2008 crisis, there was a significant presence of subprime mortgages, which were high-risk loans. These risky lending practices contributed to the collapse of the housing market. Today, the lending landscape has undergone stricter regulations and practices, reducing the prevalence of subprime mortgages.

Stricter lending standards

In response to the 2008 crisis, lending standards have become stricter in the current housing market. Financial institutions and lenders now require more stringent criteria for mortgage loan eligibility, including higher credit scores, lower debt-to-income ratios, and larger down payments. These measures aim to mitigate risk and ensure borrowers have the ability to repay their loans.

Less speculative investment

The current housing market also experiences less speculative investment compared to the pre-2008 era. Prior to the crisis, there was a significant amount of speculative buying, where investors bought properties with the intention of quickly selling them for a profit. This speculative behavior contributed to the housing bubble. Today, there is a greater emphasis on long-term investment strategies, reducing the likelihood of a speculative-driven market collapse.

This image is property of static.seekingalpha.com.

Forecasts and Predictions for the Future

Potential for stabilization in the housing market

Despite the challenges and uncertainties in the housing market, there is potential for stabilization in the future. As supply and demand dynamics adjust, and government interventions address affordability and housing needs, the market may find a more balanced equilibrium. However, the future trajectory of the housing market will depend on various economic factors and policy decisions.

Impact of economic factors on housing market

Economic factors, such as GDP growth, employment rates, and inflation, will inevitably influence the housing market. Positive economic indicators can stimulate housing market activity, while economic downturns can have a dampening effect. Keeping an eye on economic trends and understanding their influence on the housing market can help inform forecasts and predictions.

Projection for interest rate trends

Predicting interest rate trends is challenging but crucial for understanding the future of the housing market. Economists, analysts, and policymakers closely follow monetary policy decisions, inflation forecasts, and market conditions to make projections. These projections can inform homebuyers, sellers, and investors on potential borrowing costs and affordability in the future.

Long-term implications for housing affordability

Assessing long-term implications for housing affordability is essential for understanding the future housing landscape. Factors such as income growth, housing supply, government policies, and lending practices will influence affordability. Analyzing these factors and their potential trajectories can help shape expectations for housing affordability in the years to come.

Tips for Homebuyers and Sellers in a High-Interest Rate Environment

Understanding your financial capabilities

In a high-interest rate environment, it is crucial for homebuyers and sellers to have a clear understanding of their financial capabilities. This includes evaluating your income, expenses, and savings to determine your purchasing power and affordability. Understanding your financial limits can help you make informed decisions and avoid overextending yourself.

Exploring mortgage options

Given the higher interest rates, it is essential for homebuyers to explore different mortgage options. Shopping around for lenders, comparing interest rates and terms, and understanding the various loan programs available can help you find the most suitable mortgage for your financial situation. Consulting with mortgage professionals can provide valuable insights and guidance.

Evaluating housing market conditions

In a high-interest rate environment, it is important for homebuyers and sellers to closely evaluate housing market conditions. This includes assessing supply and demand dynamics, understanding local trends, and considering factors such as inventory levels and days on market. Being informed about market conditions can help you make better decisions when buying or selling a home.

Working with a real estate agent

Engaging the services of a knowledgeable and experienced real estate agent can be highly beneficial in a high-interest rate environment. An agent can provide valuable insights into the local housing market, guide you through the homebuying or selling process, negotiate on your behalf, and help you navigate challenges presented by high interest rates.

Considering long-term investment potential

For homebuyers, it is important to consider the long-term investment potential of a property, especially in a high-interest rate environment. Assessing factors such as location, potential for appreciation, and rental demand can help you make a more informed decision and potentially mitigate the impact of high borrowing costs. Considering the long-term investment potential can help you make a more strategic purchase decision.

This image is property of images.unsplash.com.